Cow Shed Subsidy and Cow Loan: How to Apply Through Gram Panchayat

Dairy farming is one of the most reliable and sustainable income sources for rural households in India. With growing demand for milk and milk products, the government actively promotes dairy entrepreneurship by providing cow shed subsidies and cow purchase loans. These benefits are especially designed for small and marginal farmers, landless laborers, women self-help groups, and unemployed rural youth.

One of the most common and trusted entry points for these schemes is the Gram Panchayat, the grassroots-level local governance institution. This guide explains everything you need to know—eligibility, subsidy structure, loan options, documents, step-by-step application process, timelines, and common mistakes—so you can apply confidently and correctly.

What Is Cow Shed Subsidy?

Cow shed subsidy is a financial assistance provided by the government to help farmers construct a scientific, hygienic shelter for dairy animals. A well-designed shed improves milk yield, animal health, and farm productivity.

Objectives of Cow Shed Subsidy

-

Improve animal welfare and hygiene

-

Reduce disease risk and veterinary costs

-

Encourage scientific dairy practices

-

Increase milk productivity and farmer income

-

Support first-time dairy entrepreneurs

The subsidy usually covers a portion of the construction cost, while the remaining amount is borne by the beneficiary or supported through a loan.

What Is Cow Loan?

A cow loan is a bank-financed credit facility that helps beneficiaries purchase cows or buffaloes and, in some cases, cover working capital like feed and insurance. Cow loans are often linked with government subsidy programs, which reduce the effective repayment burden.

What Cow Loans Typically Cover

-

Purchase of milch animals (cow or buffalo)

-

Initial feed and fodder

-

Insurance premium

-

Veterinary expenses (in some schemes)

-

Cow shed construction (if bundled)

Government Bodies Involved

-

Gram Panchayat – First contact point for verification, recommendation, and local approvals

-

NABARD – Policy guidance, subsidy routing, and refinancing to banks

-

District Animal Husbandry Department – Technical approval and inspection

-

Banks (Public/Cooperative/RRBs) – Loan sanction and disbursement

Who Is Eligible?

Eligibility may vary slightly by state, but the general criteria are consistent across India.

Individual Applicants

-

Resident of the Gram Panchayat area

-

Farmer, landless laborer, or rural youth

-

Age typically between 18 and 65 years

-

Basic experience or willingness to undergo dairy training

Priority Categories

-

Scheduled Castes (SC)

-

Scheduled Tribes (ST)

-

Women applicants

-

Self-Help Groups (SHGs)

-

Small and marginal farmers

Land Requirement

-

Own land is preferred, but leased land or showable space is accepted in many states

-

Written consent may be required if land is leased

Types of Cow Shed Subsidies

1. Individual Cow Shed Subsidy

-

For farmers owning 2–10 animals

-

Standard shed designs approved by Animal Husbandry Department

-

Subsidy typically calculated per animal or per square meter

2. Group or SHG-Based Subsidy

-

For SHGs, cooperatives, or producer groups

-

Higher subsidy ceilings

-

Encourages collective dairy entrepreneurship

3. Special Category Subsidy

-

Enhanced subsidy percentage for SC/ST/women

-

Additional support like training and insurance

Subsidy Amount and Structure (Indicative)

Subsidy amounts vary by state and scheme. Below is a typical structure for understanding purposes:

| Category | Subsidy Percentage | Maximum Amount |

|---|---|---|

| General | 25%–35% | ₹40,000–₹60,000 |

| SC/ST/Women | 33%–50% | ₹60,000–₹1,00,000 |

| SHG/Group | Up to 50% | Higher caps |

Note: Subsidy is usually released after construction and verification, not upfront.

Cow Loan Details

Loan Amount

-

Depends on number of animals and project cost

-

Commonly ranges from ₹50,000 to ₹5,00,000

Interest Rate

-

As per bank norms

-

Often reduced effectively due to subsidy

Repayment Period

-

3 to 7 years

-

Grace period of 3–6 months in many cases

Security

-

Small loans often do not require collateral

-

Animals are insured and hypothecated to the bank

Step-by-Step Application Process Through Gram Panchayat

Step 1: Initial Enquiry

Visit your Gram Panchayat office and enquire about:

-

Ongoing dairy subsidy schemes

-

Application timelines

-

Eligibility conditions

Step 2: Submit Application to Gram Panchayat

Fill the prescribed application form and submit it along with basic documents. The Panchayat secretary or development officer records your request.

Step 3: Panchayat Verification

-

Local verification of residence and land/space availability

-

Confirmation that applicant is a genuine resident

-

Recommendation letter issued by Gram Panchayat

Step 4: Animal Husbandry Department Inspection

-

Site inspection for shed feasibility

-

Approval of shed design and size

-

Technical recommendation

Step 5: Bank Loan Application

-

Submit loan proposal to a nearby bank

-

Include Panchayat recommendation and veterinary approval

-

Bank conducts financial appraisal

Step 6: Loan Sanction and Animal Purchase

-

Bank sanctions loan

-

Animals purchased from approved vendors

-

Insurance completed

Step 7: Shed Construction

-

Construct shed as per approved design

-

Maintain bills, photos, and measurements

Step 8: Final Inspection and Subsidy Release

-

Joint inspection by department officials

-

Subsidy credited to loan account or beneficiary account

Required Documents

-

Aadhaar Card

-

Ration Card or Residence Certificate

-

Caste Certificate (if applicable)

-

Bank Passbook copy

-

Land ownership or lease document

-

Passport-size photographs

-

Gram Panchayat recommendation letter

-

Animal insurance papers (post-purchase)

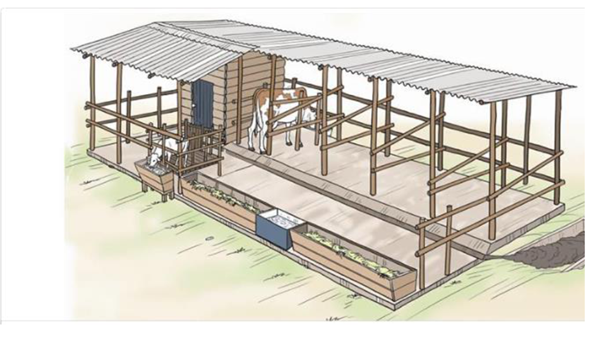

Approved Cow Shed Design Guidelines

Key design norms generally include:

-

Cemented non-slippery floor

-

Proper drainage for waste water

-

Adequate ventilation and natural light

-

Separate space for calves

-

Water trough and feeding area

Using non-approved designs may result in subsidy rejection.

Timeline From Application to Subsidy

-

Gram Panchayat verification: 1–2 weeks

-

Department inspection: 2–4 weeks

-

Bank loan processing: 2–6 weeks

-

Shed construction: 1–2 months

-

Subsidy release: After final inspection

Total time may range from 2 to 4 months, depending on state and workload.

Common Mistakes to Avoid

-

Constructing shed before approval

-

Buying animals from unapproved sellers

-

Not insuring animals

-

Submitting incomplete documents

-

Ignoring prescribed shed dimensions

Avoiding these mistakes ensures smooth subsidy approval.

Benefits of Applying Through Gram Panchayat

-

Local support and guidance

-

Faster verification

-

Transparency in beneficiary selection

-

Reduced risk of middlemen or fraud

Gram Panchayat acts as a trusted bridge between villagers and government departments.

Frequently Asked Questions

Can I apply without owning land?

Yes, in many states leased land or family-owned land with consent is allowed.

Is training mandatory?

Some schemes require short dairy training, especially for first-time applicants.

Can I apply for both cow loan and shed subsidy?

Yes, most schemes are designed to be integrated.

Is subsidy taxable?

No, government capital subsidies are generally not taxable for individuals.

apply Link

Cow shed subsidy and cow loan schemes are powerful tools to build a stable and profitable dairy business. Applying through the Gram Panchayat ensures legitimacy, guidance, and access to multiple departments without confusion. By following the correct steps, maintaining proper documentation, and adhering to approved designs, rural entrepreneurs can significantly reduce initial investment and secure long-term income.

If you are serious about dairy farming, start at your Gram Panchayat office, gather accurate information, and proceed systematically. With patience and proper planning, government support can turn dairy farming into a sustainable livelihood for you and your family.